Depositphotos Seoul, Korea.

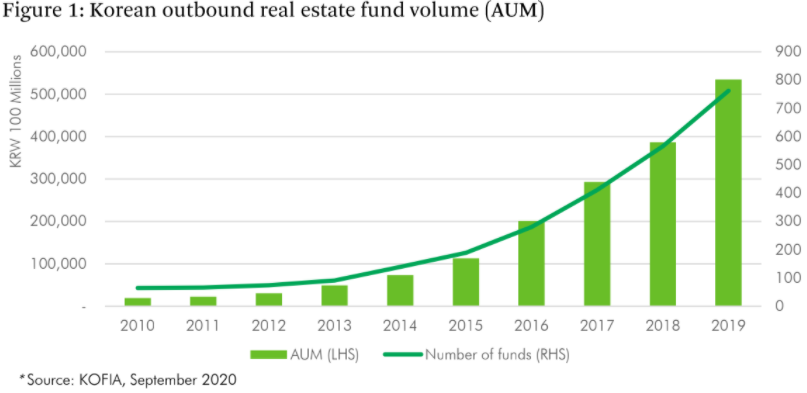

Domestic institutional investor demand for overseas real estate investment among Korean buyers is expected to remain robust despite the impact of COVID-19 due to "intense" competition in the Korean commercial real estate market and regulatory uncertainty, CBRE says.

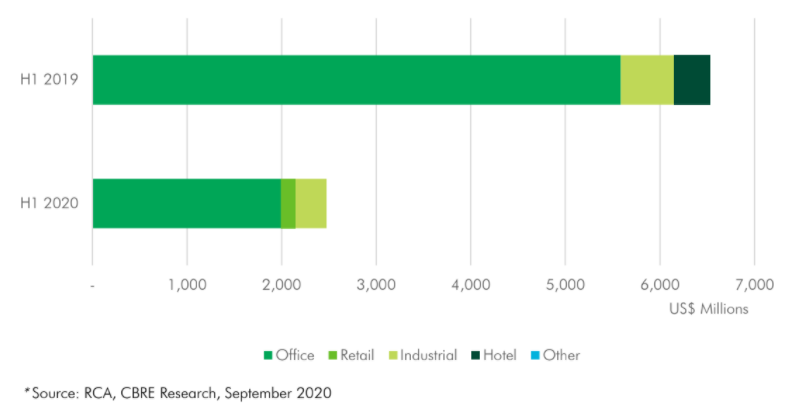

Data from the firm indicates Korean outbound real estate investment volume for H1 2020 totalled USD 2.5 billion, a decline of more than 50 per cent compared to the same period last year.

But CBRE Korea Research Director Claire Choi said Korean outbound investors were expected to recalibrate their strategies as they seek to adjust to the new normal.

At a glance:

New data from CBRE Korea indicates Korean outbound real estate investment volume for H1 2020 totalled USD 2.5 billion, a decline of more than 50 per cent compared to the same period last year.

CBRE expects investment in non-core regions as well as major core markets to broaden as buyers aim to discover new investment destinations offering higher returns.

Potential investments in major developed European markets such as France, Germany and the UK, along with key regions in Spain and Northern and Eastern Europe, are now being evaluated by Korean investors.

“Korean buyers are not only purchasing stable office assets but also purchasing overseas opportunities in the logistics sector," he said.

"Data centres and multifamily properties are likely to be the subject of stronger interest from Korean outbound investors, which are relatively resilient to economic volatility.

"On the other hand, weaker private consumption and a near-total shutdown of global tourism have led to elevated risk associated with hotel and retail property investments.”

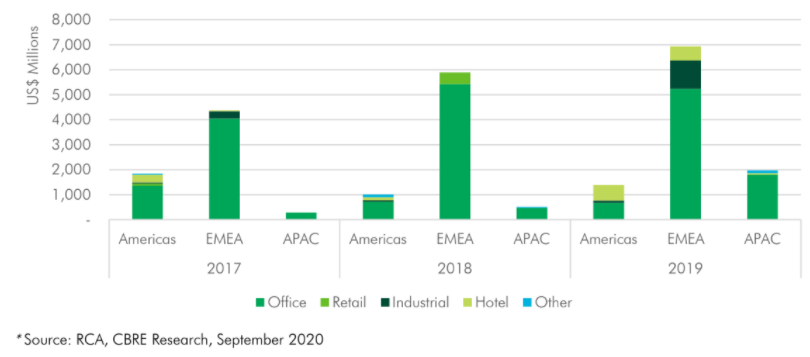

Korean outbound investment by region and asset type.

In terms of investment destinations, as competition among domestic institutional investors intensifies in Europe, CBRE expects investment in non-core regions as well as major core markets to broaden as buyers aim to discover new investment destinations offering higher returns.

Potential investments in major developed European markets such as France, Germany and the UK, along with key regions in Spain and Northern and Eastern Europe, are now being evaluated by Korean investors.

CBRE Korea Managing Director Don Lim said Korean investors were also conducting investment reviews in the U.S. and searching for investment opportunities in Asia.

"In the long run, the search by Korean investors for investment opportunities in Asia is expected to broaden as buyers seek relatively more attractive opportunities closer to home owing to intense competition and high asset values in Europe and the US," he said.

Impact of COVID-19 on Korean outbound investment.

"Individual investors are also interested in investing in overseas real estate, and they can more readily access opportunities via investing into public funds.

"In addition, overseas property-backed REITs offer reasonable growth potential in the long-term, with further K-REITs of this type expected to be listed on the stock market once an economic recovery is underway."

Click here to view the full report.

Similar to this:

Korean commercial real estate market will remain solid regardless of COVID-19 - CBRE webinar

Indications of sectors rebounding are signs of hope: CBRE

New CBRE report shows COVID-19 is 'accelerating' the evolution of Korea's office market

IMPORTANT INFORMATION:

Disclaimer

Terms and Conditions

Privacy Policy

Lawrence, Editor & Owner, President and General Manager of 16 year old Pt. Bali Affordable Lifestyles International (PT. B.A.L.I.). His spouse and partner Azizah, is a fully licensed Indonesian Notaris with a Masters degree in Indonesian Law specializing in real estate. Together they and their 60 + professional staff provide a one stop, efficient location for Buying, Selling, Leasing and Renting Asian Real Estate.

One location investors will take a look as their Southern Neighbour Bali where prices of distressed properties are selling for as much is 50% off third 2020 Highs.

If you have Bali distressed properties for sale that are selling for at least 20% below their January 2020 prices contact me direct with the information.

If it qualifies for our distress property portfolio we will market it for you.

If you're a smart real estate investor who knows that the time to buy real estate is when nobody wants it or as Baron Rothschild said when the blood is running the streets you should take a serious look at the limited amount of Bali distress sale properties we have available right now.

I am convinced that those who buy today at these distress prices will reap huge profits in the very near future as Tourists come back to Bali.

Whatsapp Lawrence at +628123814014 or email me at bestasiarealestate@gmail.com

No comments:

Post a Comment