There is bad news for homeowners with house prices expected to plunge sharply, as the reserve bank considers hiking interest rates. Alex Turner-Cohen

Alex Turner-Cohen

@AlexTurnerCohen

February 8, 2022 - 10:09AM

news.com.au06:53

'Certainly a lot of activity' in the housing market this year: Adrian Bo

Real estate coach and auctioneer Adrian Bo says there’s been “a lot of activity” in the housing market throughout this year, especially in the last quarter.

More from economy

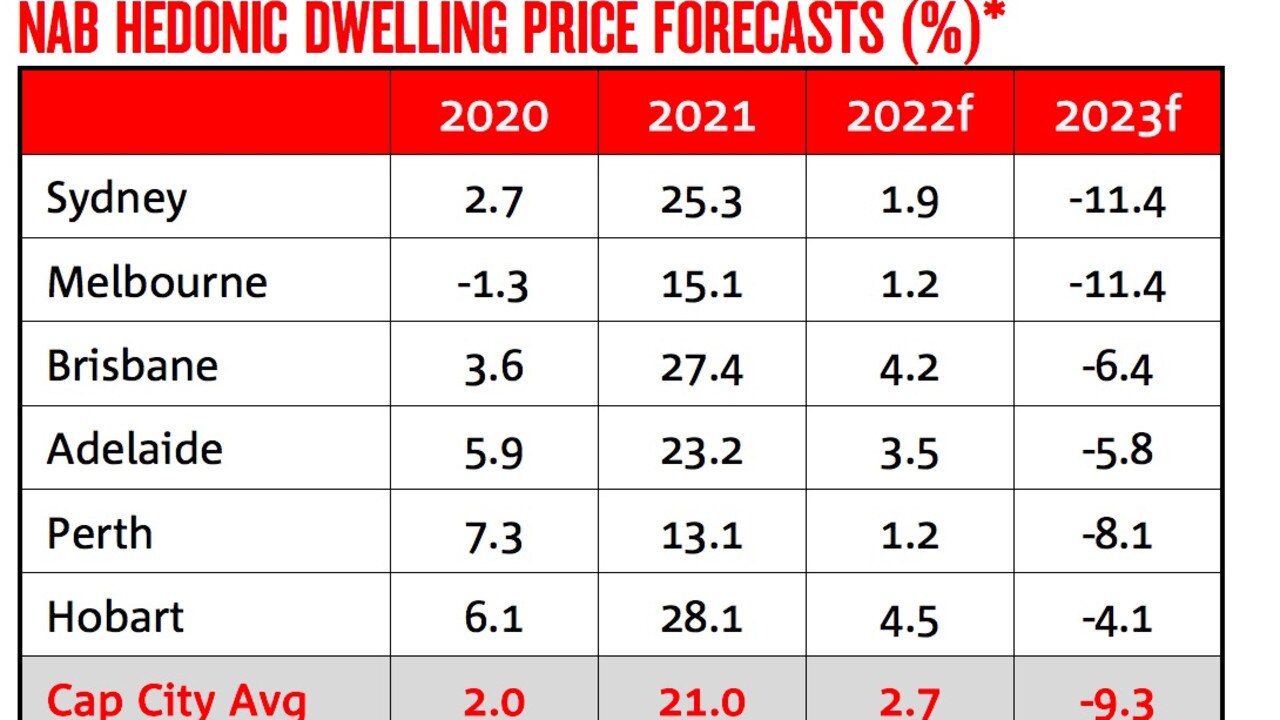

Property prices will take a turn for the worse midway through this year and by 2023 house prices will plunge by a whopping 11 per cent.

That’s according to the latest NAB forecast, released last Friday.

NAB drastically revised its initial outlook for property prices over the next two years after the Reserve Bank flagged that interest rates could rise at some point in 2022.

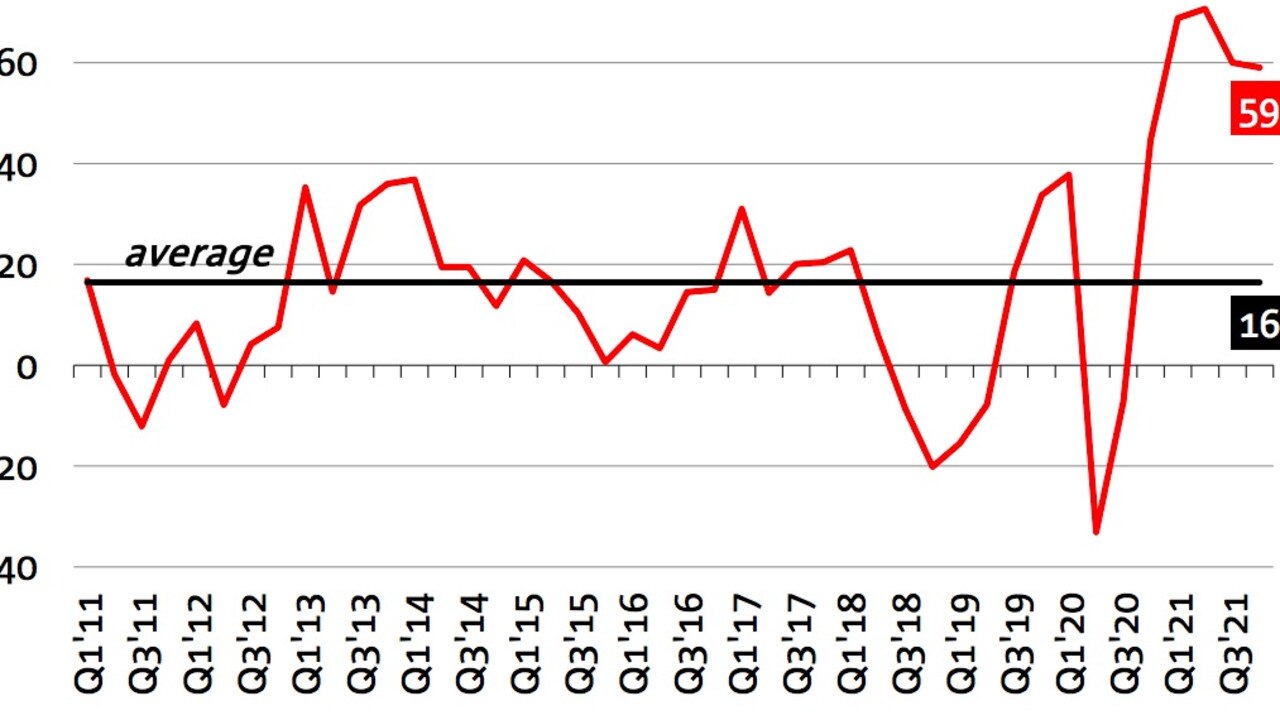

In its Residential Property Survey for the latest quarter, NAB warned: “With our view on rate hikes coming forward, we now expect the turning point in property prices to occur in the second half of 2022.”

The looming promise of rising interest rates means their outlook for this year will see prices significantly “flatter” than before while we will see “a slightly larger fall” for 2023.

Property is set to rise in value by just three per cent in the coming year.

That’s a pitiful amount compared to last year, when Australian real estate soared by 22 per cent in a boom that hadn’t been seen since the mid-1980s.

Stream more finance news live & on demand with Flash, a dedicated news streaming service. New to Flash? Try 14 days free now >

Although next year’s 11 per cent decline might seem like a big drop, the report’s author said it was actually quite a controlled plunge.

“We see this as a relatively orderly decline,” the report noted.

“It is important to remember this correction comes after a very sharp run up in prices over the last year.”

NAB brought forward its predictions of a correction off the back of rising interest rate expectations.

“In terms of forecasts, we have brought forward the timing of the correction we expect in house prices to late-2022 as affordability constraints begin to bite and rising mortgage rates place downward pressure on prices,” the bank said.

“This would offset gains seen in early-2022, so that overall, prices end the year roughly flat. We see this trend continuing through 2023, ending the year around 10 per cent lower.”

Sydney and Melbourne will be hit hardest, dropping by nearly 12 per cent each next year.

Both metropolitan property markets will only 1.9 and 1.2 per cent respectively for 2022, a snail’s pace compared to previous periods of time.

Hobart would experience the lowest drop for 2023, at only 4 per cent.

The combined capital city average was forecast to be a 9.4 per cent decrease next yar.

Interest rates could rise as early as November this year, NAB warned.

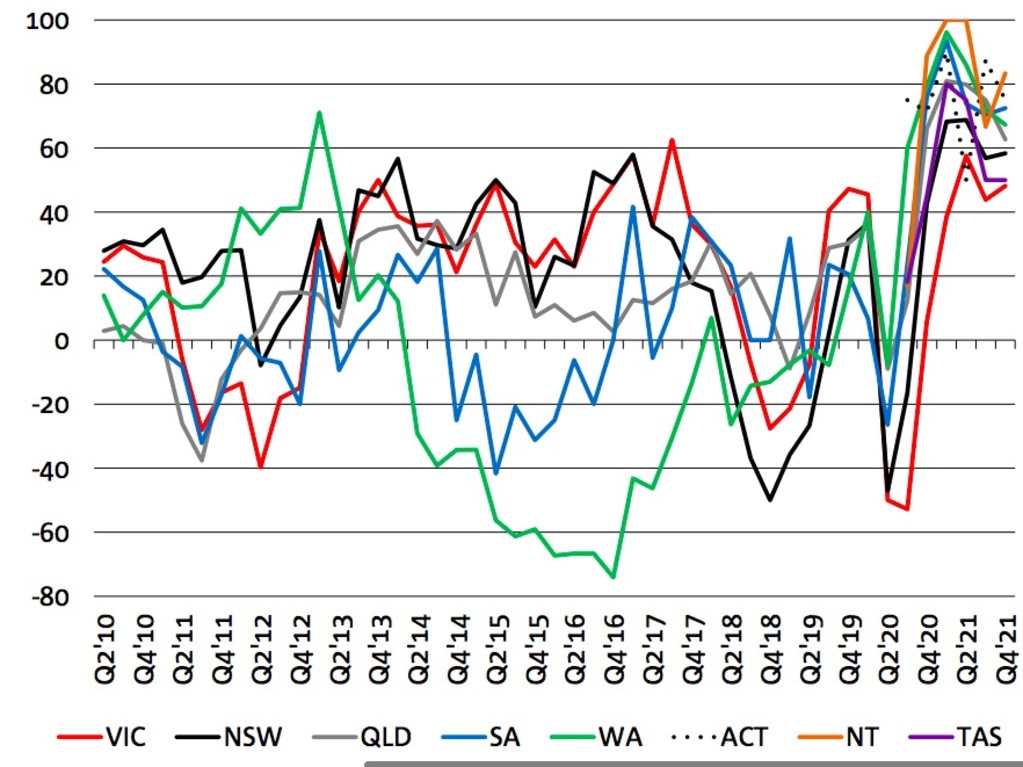

With Covid Omicron case numbers soaring in some parts of the country and not others, some housing markets are set to rise this year and others are expected to drop considerably.

Confidence levels are now highest in the Northern Territory and the ACT, while they’ve never been lower in Tasmania, Victoria, NSW and Queensland.

The report stated: “The 2-year confidence measure was highest in the NT (+92 pts) and ACT (+75 pts).

More CoverageHouse prices growing faster than we can saveShock new average price of Aussie house

“The biggest declines [were] noted in SA (down 15 to +61 pts), WA (down 13 to +67 pts), QLD (down 10 to +54 pts) and NSW (down 9 to +55 pts).”

There is a short-term bullish outlook for Victoria but then confidence will wane.

No comments:

Post a Comment